Hong Kong Set to Issue First Stablecoin Licenses by March 2024

Hong Kong's Financial Secretary has announced plans to issue the first stablecoin licenses as part of the city's efforts to establish itself as a global crypto hub. This initiative is expected to attract innovation and investment in the digital currency sector.

Hong Kong's Ambitious Move into Stablecoins

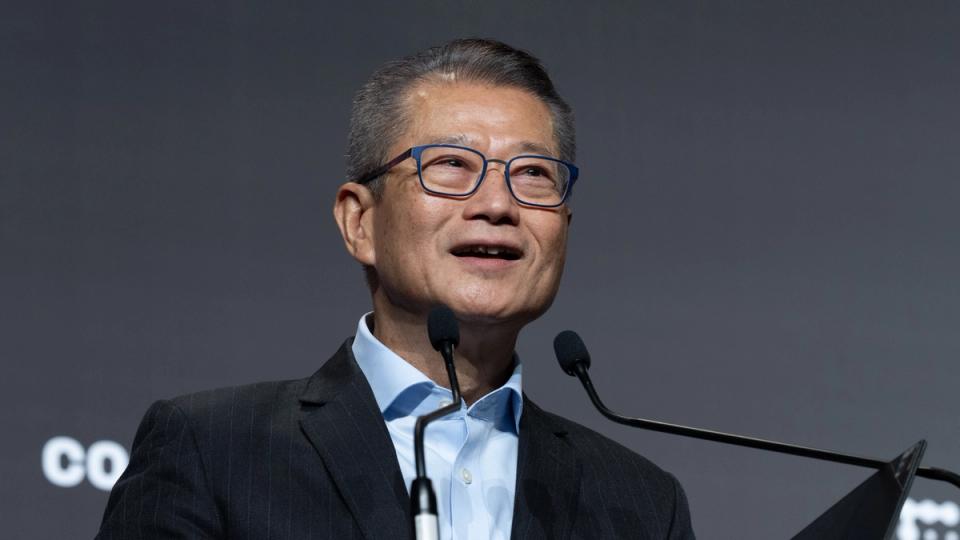

In a significant development for the cryptocurrency landscape, Hong Kong's Financial Secretary, Paul Chan, has confirmed that the city is preparing to issue its first stablecoin licenses by March 2024. This initiative aligns with Hong Kong's broader strategy to position itself as a leading global financial center and a hub for digital innovation.

Regulatory Framework and Licensing Process

The announcement comes as part of a comprehensive regulatory framework aimed at fostering a safe and secure environment for the burgeoning cryptocurrency market. The Hong Kong Monetary Authority (HKMA) is expected to oversee the licensing process, ensuring that stablecoin issuers adhere to stringent guidelines that prioritize consumer protection and financial stability.

Chan emphasized that the introduction of stablecoin licenses is a crucial step in enhancing the credibility of digital currencies in the region. "We want to create a regulatory environment that encourages innovation while safeguarding the interests of investors and the integrity of our financial system," he stated during a recent press conference.

Potential Impact on the Financial Sector

The issuance of stablecoin licenses is anticipated to have a profound impact on Hong Kong's financial sector. Stablecoins, which are digital currencies pegged to stable assets such as the US dollar, offer a less volatile alternative to traditional cryptocurrencies like Bitcoin and Ethereum. This stability makes them attractive for various applications, including remittances, payments, and as a store of value.

Industry experts believe that the move could catalyze the growth of decentralized finance (DeFi) platforms and other blockchain-based services in Hong Kong. By providing a regulatory framework for stablecoins, the city aims to attract both local and international companies looking to innovate in the digital currency space.

Global Context and Competitive Landscape

As countries around the world grapple with the regulatory challenges posed by cryptocurrencies, Hong Kong's proactive approach sets it apart from many jurisdictions. While some nations have imposed strict bans or limitations on digital currencies, Hong Kong is embracing the potential benefits of blockchain technology and digital assets.

In recent months, other regions, including the European Union and the United States, have also been exploring frameworks for regulating stablecoins, indicating a growing recognition of their significance in the global financial ecosystem. However, Hong Kong's swift action to issue licenses could provide it with a competitive edge in attracting crypto-related businesses and investments.

Community Reactions and Future Prospects

The announcement has been met with enthusiasm from the local cryptocurrency community, which sees it as a validation of the industry's potential. Many stakeholders believe that a clear regulatory framework will not only enhance investor confidence but also stimulate innovation and competition among stablecoin issuers.

Looking ahead, the successful implementation of stablecoin licenses could pave the way for further advancements in Hong Kong's digital economy. As the city continues to develop its regulatory landscape, it remains to be seen how these changes will influence the broader adoption of cryptocurrencies and blockchain technology in the region.

Conclusion

Hong Kong's decision to issue stablecoin licenses marks a pivotal moment in its journey towards becoming a global leader in the cryptocurrency space. With a focus on regulatory clarity and consumer protection, the city is poised to attract innovation and investment, solidifying its status as a key player in the evolving digital economy.