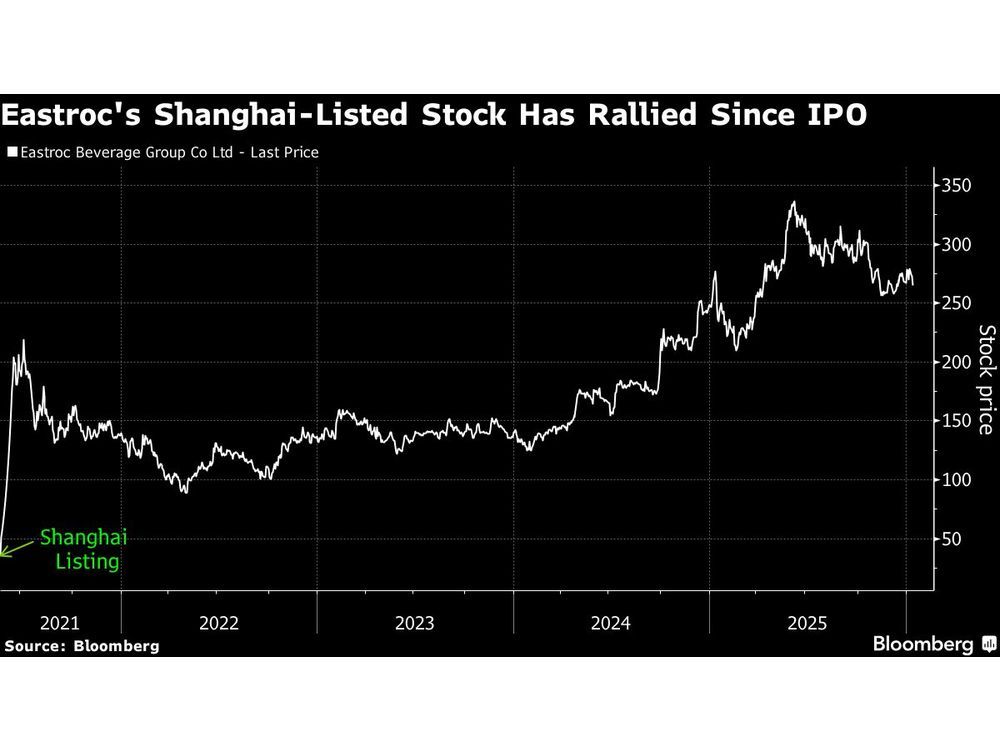

Eastroc Beverage Explores Billion-Dollar Hong Kong Listing Amid Growing Demand

Eastroc Beverage, a prominent Chinese drinks maker, is reportedly assessing interest for a potential listing in Hong Kong that could exceed one billion dollars. This move comes as the company seeks to capitalize on the increasing demand for its products in both domestic and international markets.

Eastroc Beverage's Ambitious Plans

Eastroc Beverage, a leading Chinese beverage manufacturer known for its popular energy drinks, is reportedly gauging interest for a potential listing on the Hong Kong Stock Exchange. The company is looking to raise over one billion dollars through this IPO, which reflects its ambitions to expand its market presence and capitalize on the growing demand for its products.

Market Dynamics and Growth Potential

The beverage market in Asia, particularly in China, has been witnessing a significant transformation in recent years. With a rising health consciousness among consumers and a growing preference for functional beverages, companies like Eastroc are well-positioned to benefit from these trends. The company's energy drinks, which have gained popularity among younger demographics, are expected to drive substantial revenue growth.

Strategic Timing for IPO

Experts suggest that the timing of Eastroc's potential IPO could be advantageous. The Hong Kong market has seen a resurgence in IPO activity, with several companies successfully raising capital amid a recovering economy. As investors look for opportunities in the consumer goods sector, Eastroc's strong brand recognition and market share could attract significant interest.

Company Background and Performance

Founded in 1995, Eastroc Beverage has established itself as a key player in the Chinese beverage industry. The company specializes in producing a range of drinks, including energy drinks, fruit juices, and teas. Over the years, Eastroc has focused on innovation and quality, which has allowed it to capture a loyal customer base. In recent financial reports, the company has shown impressive growth, with revenues increasing significantly year-on-year.

Challenges Ahead

Despite its strong market position, Eastroc Beverage faces challenges that could impact its IPO plans. The beverage industry is highly competitive, with numerous domestic and international players vying for market share. Additionally, regulatory hurdles and market fluctuations could pose risks to the company's growth trajectory. Investors will be keenly observing how Eastroc navigates these challenges as it prepares for its potential listing.

Investor Sentiment and Future Outlook

Investor sentiment towards Eastroc's IPO is expected to be influenced by the company's ability to demonstrate sustainable growth and profitability. Analysts will be looking for clear indicators of how Eastroc plans to utilize the funds raised from the IPO, particularly in terms of expanding its product lines and enhancing its distribution capabilities. The company's commitment to innovation and quality will be critical in maintaining consumer interest and driving future sales.

Conclusion

As Eastroc Beverage explores the possibility of a billion-dollar listing in Hong Kong, the company stands at a pivotal moment in its growth journey. With a strong brand, a growing market, and a strategic approach to capitalizing on consumer trends, Eastroc has the potential to emerge as a significant player on the global stage. The upcoming months will be crucial as the company gauges investor interest and prepares for what could be a landmark IPO in the beverage industry.