Asian Institutions Shift Focus Towards Stablecoins Amid Crypto Market Evolution

As the cryptocurrency landscape continues to evolve, Asian institutions are increasingly pivoting towards stablecoins as a preferred digital asset. This shift reflects a broader trend in the global financial system, highlighting the growing importance of stability in the volatile crypto market.

Introduction

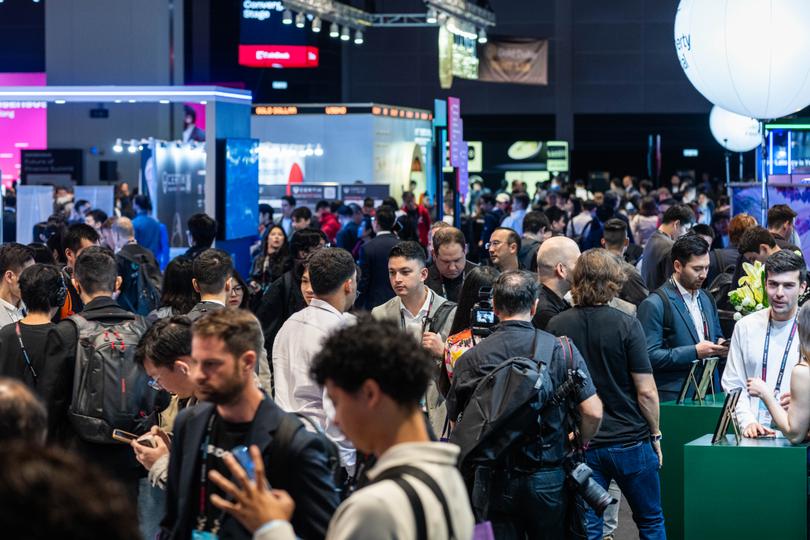

The cryptocurrency market has experienced significant fluctuations over the past few years, prompting a strategic pivot among Asian institutions towards stablecoins. This trend, identified by experts at Consensus, signifies a shift in how financial entities in Asia are approaching digital assets, prioritizing stability and regulatory compliance in an ever-changing economic landscape.

The Rise of Stablecoins

Stablecoins, which are cryptocurrencies designed to maintain a stable value by pegging them to a reserve of assets, have gained traction as a reliable alternative to traditional cryptocurrencies like Bitcoin and Ethereum. Unlike their more volatile counterparts, stablecoins offer a sense of security and predictability, making them attractive to institutional investors and businesses alike.

Asian Institutions Embrace Change

According to recent insights from Consensus, many Asian financial institutions are recognizing the potential of stablecoins to enhance liquidity and facilitate cross-border transactions. This pivot is particularly evident in countries like Hong Kong and Singapore, where regulatory frameworks are becoming more conducive to the adoption of digital assets.

Regulatory Landscape

The regulatory environment in Asia is evolving, with governments and financial authorities actively seeking to integrate cryptocurrencies into their financial systems. In Hong Kong, for instance, the Securities and Futures Commission (SFC) has taken steps to regulate stablecoins, providing a clearer framework for their use. This regulatory clarity is encouraging institutions to explore stablecoins as a viable option for both investment and operational purposes.

Benefits of Stablecoins for Institutions

Stablecoins offer several advantages for institutions looking to navigate the complexities of the digital asset landscape. Firstly, they provide a hedge against the volatility commonly associated with cryptocurrencies, allowing institutions to hold digital assets without the fear of drastic price swings. Secondly, stablecoins can streamline cross-border transactions, reducing the time and costs associated with traditional banking methods.

Market Adoption and Future Outlook

As more Asian institutions begin to adopt stablecoins, the market is likely to see increased liquidity and a broader acceptance of digital assets. Experts predict that this trend will not only enhance the functionality of stablecoins but also pave the way for innovative financial products and services that leverage blockchain technology.

Challenges Ahead

Despite the positive outlook, there are challenges that institutions must navigate as they embrace stablecoins. Regulatory uncertainties, potential market manipulation, and the need for robust security measures are all concerns that institutions must address. Additionally, the competition among stablecoin providers is intensifying, with various projects vying for market dominance.

Conclusion

The pivot towards stablecoins by Asian institutions marks a significant development in the cryptocurrency landscape. As these entities seek stability and regulatory compliance, stablecoins are poised to play a crucial role in the future of digital finance. With ongoing advancements in technology and regulatory frameworks, the adoption of stablecoins is expected to grow, further integrating them into the global financial system.