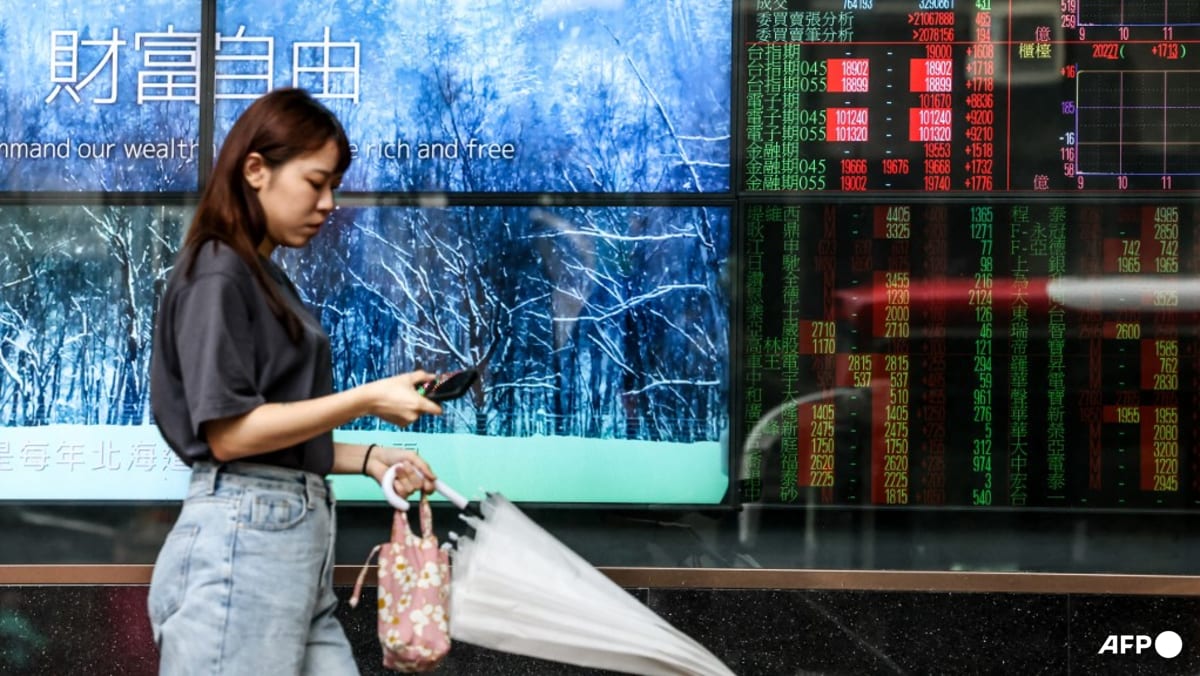

Asia Markets Edge Up Amid Thinned Holiday Trade

Asian markets showed slight gains as trading activity slowed down due to the holiday season. Investors remain cautious, balancing optimism over economic recovery with concerns about inflation and global supply chain disruptions.

Asian Markets Experience Modest Gains

Asian markets experienced a modest uptick on Monday, as investors navigated through a thinned holiday trade environment. The trading volume was significantly lower due to the ongoing holiday season, which has traditionally seen a dip in market activity. Despite this, market sentiment remained cautiously optimistic, buoyed by recent economic indicators suggesting a gradual recovery across the region.

Key Indices Show Positive Movement

In Japan, the Nikkei 225 index rose by 0.5%, closing at 28,000 points, while the Topix index also recorded a similar increase. The gains were attributed to a mix of positive corporate earnings reports and a weaker yen, which has made Japanese exports more competitive in global markets. Meanwhile, South Korea's Kospi index climbed 0.6%, supported by gains in technology stocks, as major firms like Samsung and LG Electronics reported strong holiday sales.

Chinese Markets React to Economic Data

In mainland China, the Shanghai Composite Index edged up by 0.3%, reflecting a cautious optimism among investors following the release of better-than-expected economic data. Recent figures indicated an uptick in manufacturing activity, which has provided a glimmer of hope for a more robust recovery in the world's second-largest economy. However, concerns about inflation and potential regulatory crackdowns continue to loom over the market, keeping investors on edge.

Hong Kong's Market Performance

Hong Kong's Hang Seng Index also saw a slight increase of 0.4%, driven by gains in financial and real estate sectors. Analysts noted that while the market is benefiting from a seasonal boost, the overall sentiment remains tempered by geopolitical tensions and uncertainties surrounding the COVID-19 pandemic. The city's economy has been gradually reopening, but the pace of recovery is still under scrutiny.

Investor Sentiment and Global Factors

Investor sentiment across Asia has been influenced by global factors, particularly the ongoing discussions regarding interest rate hikes by central banks in the United States and Europe. The Federal Reserve's recent signals regarding potential rate increases have raised concerns about the impact on emerging markets, including those in Asia. As a result, many investors are adopting a wait-and-see approach, preferring to remain cautious amid the prevailing uncertainties.

Looking Ahead: Economic Outlook

Looking ahead, analysts predict that the Asian markets will continue to face volatility as they grapple with inflationary pressures and supply chain disruptions. The holiday season typically sees a slowdown in trading, but as the new year approaches, market participants will be keenly watching for any signs of economic stabilization. The upcoming earnings season is expected to provide further insights into the health of various sectors, particularly in technology, consumer goods, and manufacturing.

Conclusion

In conclusion, while Asian markets have shown slight gains amid thinned holiday trade, the overall outlook remains cautious. Investors are weighing the positives of economic recovery against the backdrop of inflation and geopolitical tensions. As the region continues to navigate these challenges, market participants will be looking for clearer signals that could determine the trajectory of the markets in 2024.